Business

2025/9/5

2025/9/5

source: International daily

source: International daily

Print

Print

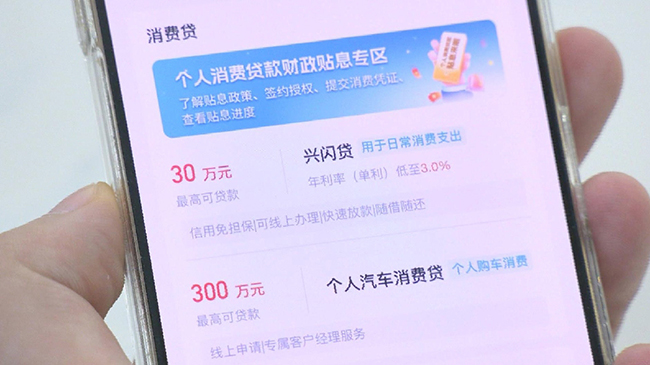

China's new personal consumption loan interest subsidy policy officially came into effect on Monday, allowing residents to enjoy financial relief when borrowing for eligible consumer spending.

Under the policy, the government will subsidize 1 percentage point of interest on qualified personal consumption loans, equivalent to about one-third of the current average lending rate for such loans.

The subsidy applies to actual spending in key sectors, including household appliances, automobiles, healthcare, education, cultural tourism, housing renovation, and electronics. For loans above 50,000 yuan, the subsidy is capped at that threshold, and a single borrower can receive up to 3,000 yuan in subsidies at one lending institution.

Banks across the country reported a surge of inquiries from customers eager to learn about the application process and subsidy amounts.

Financial institutions have conducted multiple rounds of testing and staff training in preparation for the rollout.

A total of six major state-owned commercial banks, 12 joint-stock banks, and five consumer finance companies have completed system upgrades to enable the subsidy feature. Most institutions began offering the service on Monday.

"Customers can apply for subsidized loans either online or at bank branches. After signing a supplementary agreement, the system will automatically verify eligible consumption through transaction feedback and apply the subsidy directly during repayment. Customers will also receive SMS notifications detailing the subsidy," said Zhu Ying, deputy General Manager of China Everbright Bank's Beijing branch.